Platforms and Tools

Core Marketing Platforms

Core Marketing Platforms are marketing applications that all loan officers have access to at no charge.

Surefire CRM by Top of Mind Networks

Surefire CRM and Mortgage Marketing Engine helps thousands of mortgage professionals win new business, drive repeat business, and earn the right to referral business. With intuitive, set-it-and-forget-it workflows and award-winning content, mortgage professionals can effortlessly maintain and deepen their connections with borrowers, recruits, members, brokers, and real estate agents all through one powerful platform.

Watch an overview Video of Surefire

OSI Express Mortgage Flyers

Create, manage, automate, and share your marketing material effectively. Take your business to the next level with innovative solutions. Discover how it works and transform your marketing strategy today! Experience industry leading mortgage marketing solutions with OSI Express.

Watch an overview Video of OSI Express

Hearsay Social

Hearsay Social makes it remarkably easy to drive brand awareness and effectively connect with clients through authentic interactions and tailored, personalized messaging, rather than relying on generic, canned responses.

Watch an overview Video of Hearsay Social

Marketing Add-ons

Marketing Add-ons are applications that loan officers can sign up for at a monthly cost.

Please note that the sign-up process must begin with SWBC, not directly with the vendor, as this ensures access to our corporate pricing.

BombBomb Video Messaging

BombBomb helps loan officers stand out and stay connected with video messages. Success in mortgage comes from relationships and referrals, but making time for personal outreach is hard. With BombBomb video messaging your communication has more impact in less time.

MONTHLY PRICING

The Individual Plus plan is $33 per month.

Watch an overview Video of BombBomb

CardTapp Digital Business Card

CardTapp provides loan officers with a personalized mobile app that enhances client engagement, streamlines lead management, and improves communication. It offers clients easy access to mortgage tools and direct contact, while loan officers receive real-time alerts to track interactions and follow up. Co-branding with real estate agents boosts referrals, and the app keeps the loan officer top of mind on clients' mobile devices, ultimately driving business growth and productivity.

MONTHLY PRICING

$35 per month

Watch an overview Video of CardTapp

Homebot

Homebot positions you as the go-to advisor your clients can rely on to make informed home finance decisions. Loan officers, like you, are using Homebot to generate business by engaging their entire client-base every month with valuable home finance insights, as well as helping prospective homebuyers explore markets.

MONTHLY PRICING

Homebot is $150 per month. This cost includes 5 agent co-sponsorships. The monthly cost for additional agent co-sponsorships is an extra $10 per month, per agent.

Watch an overview Video of Homebot

Partner Intel

Partner Intel is designed to help Loan Officers partner with more agents, more effectively. The user-friendly experience makes it easy to access agent and lender insights, review historical productivity data, and develop personalized outreach that enhances your agent partnership strategy.

Partner Intel can be used for:

Agent prospecting

Understanding existing agent relationships

Loan officer and lending company/branch prospecting

MONTHLY PRICING

$45 per month

Watch an overview Video of Partner Intel

Yext

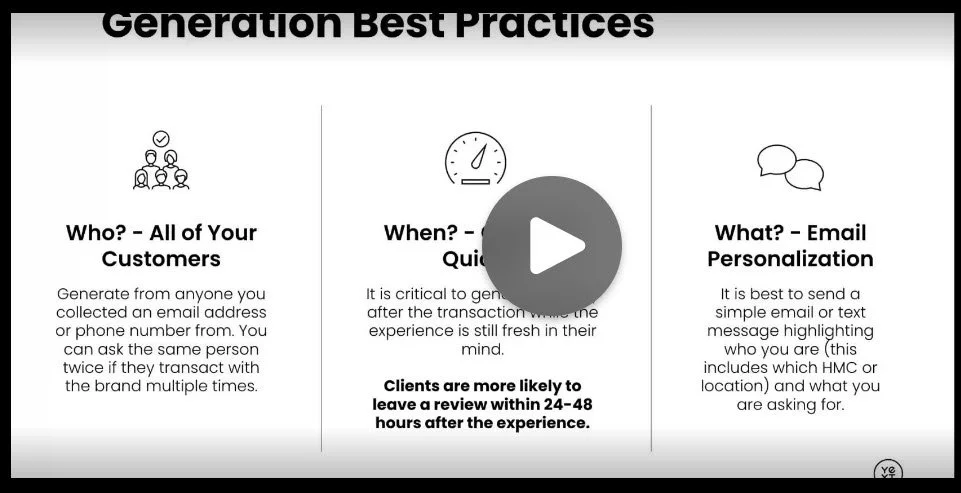

Loan officers can significantly benefit from using Yext's Listings and Reviews platforms by enhancing their online presence and reputation management. Yext Listings ensures that their contact information, business hours, and services are accurately displayed across multiple online directories, improving their visibility in local search results. This consistency builds trust with potential clients and helps drive more qualified leads. Additionally, Yext Reviews allows loan officers to monitor and respond to customer feedback, fostering positive relationships and showcasing their expertise. By collecting and promoting positive reviews, loan officers can strengthen their credibility, attract more clients, and ultimately close more deals.

MONTHLY PRICING

$35 per month

Watch an overview Video of Yext